- Best overall: Wrike

- Best for a range of project scales: Asana

- Best for collaboration: Teamwork

- Best for custom visualization and reporting: ClickUp

- Best for complex projects: Smartsheet

- Best for diagramming: Creately

- Best for collaborative whiteboarding: Miro

One of the key purposes of project management software is organization. The ability to simultaneously manage people, priorities, deadlines, tasks, and timelines from one centralized place is a huge benefit for any company.

Some projects also require teams to monitor, as well as visualize, a project’s critical path. Not all project management solutions have this capability, so I’ve compared some of the best choices to help you determine the best fit for your business.

Featured Partners

Top critical path software comparison

The table below compares options based on the most important criteria when choosing critical path software.

| Wrike | |||||

| Asana | |||||

| Teamwork | |||||

| ClickUp | |||||

| Smartsheet | |||||

| Creately | |||||

| Miro |

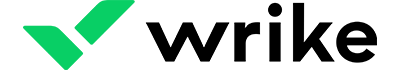

Wrike: Best overall

Star rating: 4.6/5

Wrike is my pick for the best overall software thanks to its combination of features, customization options, and types of users. It helps you manage tasks, workflows, and resources, and teams can track time, progress, and shared analytics all in one place. The software offers work visualization with custom views, real-time reports, and interactive Gantt charts. You can map out critical paths and track milestones and task dependencies in your projects easily.

Why I chose Wrike

I chose Wrike because of its capacity to manage large-scale, complex projects with an enterprise focus while also being adaptable to teams of all sizes. I found Wrike to stand out because it’s both highly customizable and packed with features.

Pricing

- Free: Unlimited users and 2GB of storage.

- Team: $10.00 per user per month, billed annually.

- Business: $24.80 per user per month, billed annually.

- Enterprise: Contact sales.

- Pinnacle: Contact sales.

Features

- Task and subtask management and custom work views like calendar or kanban.

- Team work schedules, individual work schedules, and customer statuses.

- Data visualization, real-time reporting, and real-time Gantt charts.

- Generative AI for projects and decision-making.

- Project templates, forms, and blueprints.

- Time tracking, budgeting, and timesheets.

- Ability to add guests and collaborators.

Pros and cons

| Pros | Cons |

|---|---|

|

|

For more information, read this full Wrike review.

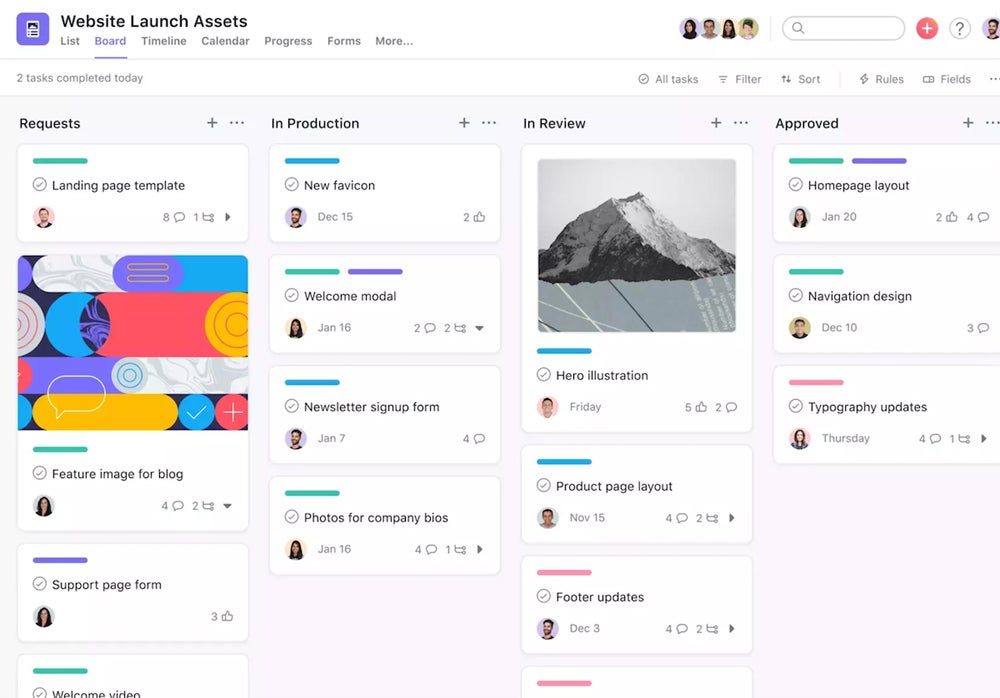

Asana: Best for a range of project scales

Star rating: 3.9/5

Asana is a versatile tool that can handle both simple and complex projects efficiently. Teams can manage goals, milestones, and task dependencies, plus access customizable templates and a chart library. Gantt chart timelines make it easy to keep track of goals and milestones.

Why I chose Asana

Asana stands out for its ability to handle a wide range of project complexities. Its comprehensive feature set, including robust task management and visualization tools, makes it a reliable choice for different project scales.

Pricing

- Personal: $0 per user with unlimited projects.

- Starter: $10.99 per user per month, billed annually, or $13.49 per user per month, billed monthly.

- Advanced: $24.99 per user per month, billed annually, or $30.49 per user per month, billed monthly.

Features

- Multiple work views like lists, calendars, and boards.

- Unlimited messaging, projects, and tasks.

- Unlimited storage but only 100MB per file.

- Teams can set task dependencies to manage workloads.

- Gantt charts timelines and abilities to visualize milestones.

- Chart template library.

- Time tracking and reporting.

Pros and cons

| Pros | Cons |

|---|---|

|

|

For more information, read this full Asana review.

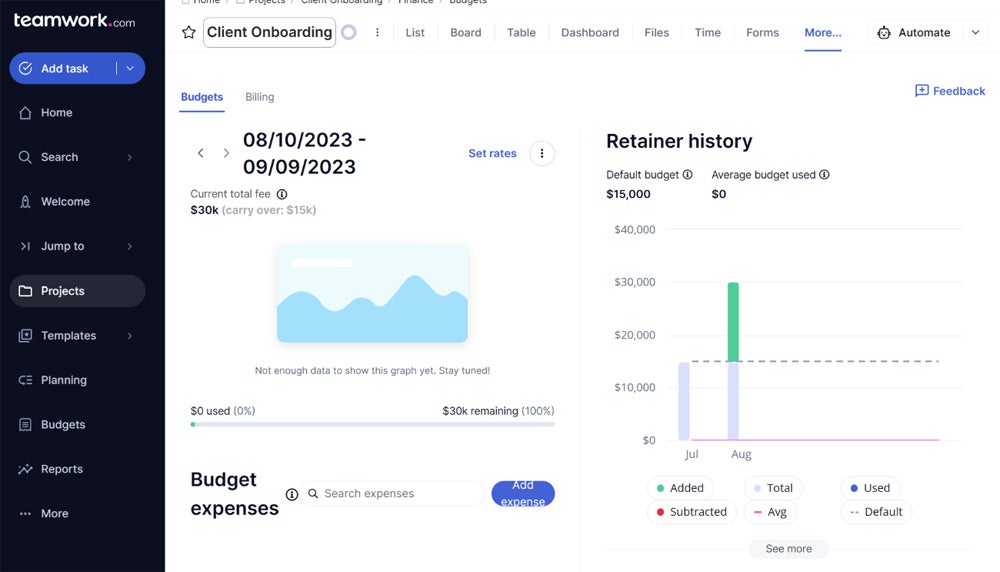

Teamwork: Best for collaboration

Star rating: 3.7/5

Teamwork has great time tracking, reporting, and collaboration features. You can use templates for projects and tasks, as well as track and manage progress. Teams can view progress with Gantt charts and save Gantt filters for quick reference. Teamwork also allows you to set dependencies and monitor vital milestones for projects.

Why I chose Teamwork

I chose Teamwork for its strong focus on collaboration. I found it to be ideal for teams that require extensive communication along with progress tracking. In addition to capabilities like Gantt charts and task dependencies, Teamwork shines through its financial features, such as budgeting and invoicing.

Pricing

- Free Forever: Five users and 100MB storage.

- Starter: $5.99 per user per month, billed annually, or $8.99 per user per month, billed monthly.

- Deliver: $10.99 per user per month, billed annually, or $13.99 per user per month, billed monthly.

- Grow: $19.99 per user per month, billed annually, or $25.99 per user per month, billed monthly.

- Scale: Contact sales.

Features

- Multiple project views like list, table, and Gantt.

- Templates for projects and tasks.

- Variety of reporting options, including time, status, and profitability.

- Ability to set dependencies and track changes and milestones.

- Financial features like budgeting, tracking user rates, invoicing, and QuickBooks integration.

- Collaborators and team chat for all plans.

Pros and cons

| Pros | Cons |

|---|---|

|

|

For more information, read this full Teamwork review.

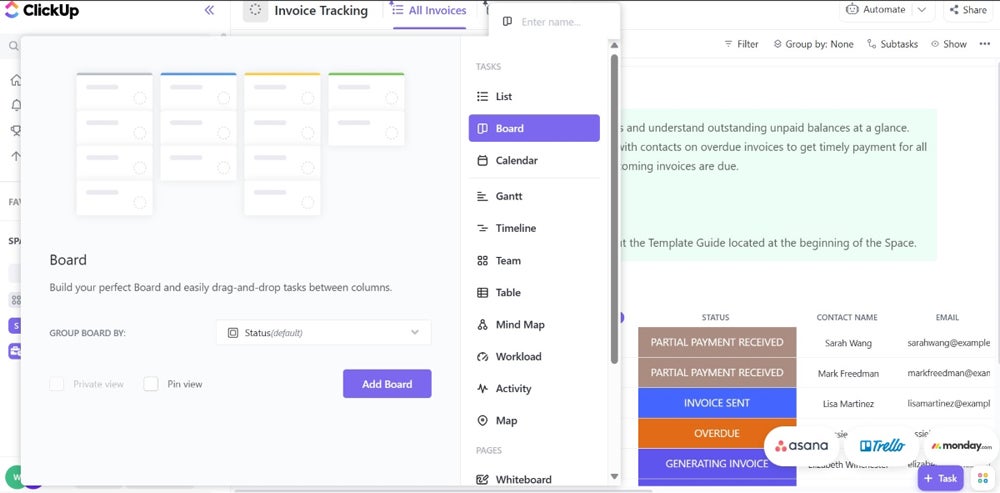

ClickUp: Best for custom visualization and reporting

Star rating: 5/5

With a variety of features and custom work views, ClickUp provides the tools to help teams stay on track. I found it to be more affordable compared to some competitors, plus it has a strong free plan to get started. It also has advanced and detailed reporting options as well as task management.

Why I chose ClickUp

ClickUp’s extensive customization options and detailed reporting capabilities are its standout qualities. ClickUp has more than 15 customizable views, ranging from simple to advanced task views, followed by detailed task reporting to offer great visualization and reporting flexibility to its users.

Pricing

- Free Forever: Unlimited users and 100MB storage.

- Unlimited: $7 per user per month, billed annually, or $10 per user per month, billed monthly.

- Business: $12 per user per month, billed annually, or $19 per user per month, billed monthly.

- Enterprise: Contact sales.

Features

- Wide variety of work views, including list, calendar, and Gantt.

- Unlimited tasks, workspaces, and custom views.

- Multiple reporting capabilities, including tracking goals, time, milestones, and sprints.

- Track specific critical paths with both Gantt charts and Slack and automate calculations.

- Sharing and ability to add guests.

- Task checklists, tagging, marking priorities.

- Team sharing, commenting, in-app recording, and notifications to stay on the same page.

Pros and cons

| Pros | Cons |

|---|---|

|

|

For more information, read this full ClickUp review.

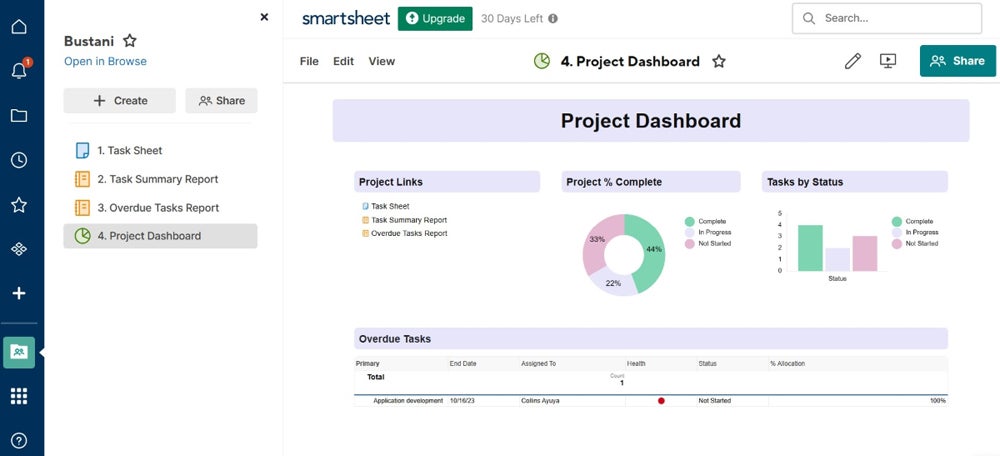

Smartsheet: Best for complex projects

Star rating: 3.8/5

One of the best data and project organization tools for spreadsheet lovers, Smartsheet takes advantage of the familiarity of spreadsheets to deliver advanced project management features. Its feature-rich platform offers task dependencies, collaboration, data visualization, and a variety of templates.

Pricing

- Free: No cost for up to one user and two editors.

- Pro: $9 per user per month billed annually, or $12 per user per month billed monthly.

- Business: $19 per user per month billed annually, or $24 per user per month billed monthly.

- Enterprise: Customized pricing.

Features

- Work views such as grid, calendar, card, and Gantt.

- Templates for sheets, reports, and dashboards in all plans.

- Ability to set dependencies, save filters, and manage team activity logs.

- Unlimited viewers in paid plans and unlimited editors in Business and Enterprise plans.

- Ability to assign members to projects, comments, and conversations for team communication.

Pros and cons

| Pros | Cons |

|---|---|

|

|

For more information, read this full Smartsheet review.

Creately: Best for diagramming

Creately is collaboration software that excels in visualizing complex processes through diagramming. It’s a tool worth considering for teams that need to create flowcharts, mind maps, and other diagrams to plan out project workflows and dependencies. Creately’s intuitive interface and extensive template library make it easy to start visualizing projects right away.

Why I chose Creately

I decided to highlight Creately because it has the strongest diagramming capabilities compared to the other software on this list. From advanced diagramming and whiteboards to visual project management and execution tools, Creately is a good choice for teams that need to visualize complex project processes and dependencies clearly.

Pricing

- Free: No cost for up to three canvases.

- Personal: $5 per month billed annually or $8 billed monthly.

- Team: $5 per user per month billed annually, or $8 per user per month billed monthly.

- Business: $89 per month billed annually or $149 per month billed monthly.

- Enterprise: Custom pricing for large teams.

Features

- Extensive diagramming and flowchart tools.

- Real-time collaboration with team members.

- 8,000+ customizable templates for various project types.

- Visual research and analysis capabilities.

- Comments and tasks.

Pros and cons

| Pros | Cons |

|---|---|

|

|

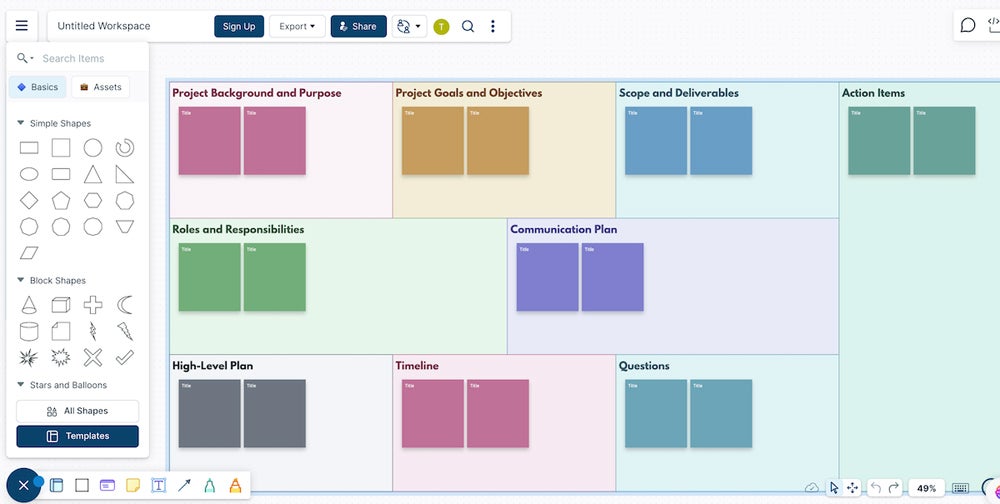

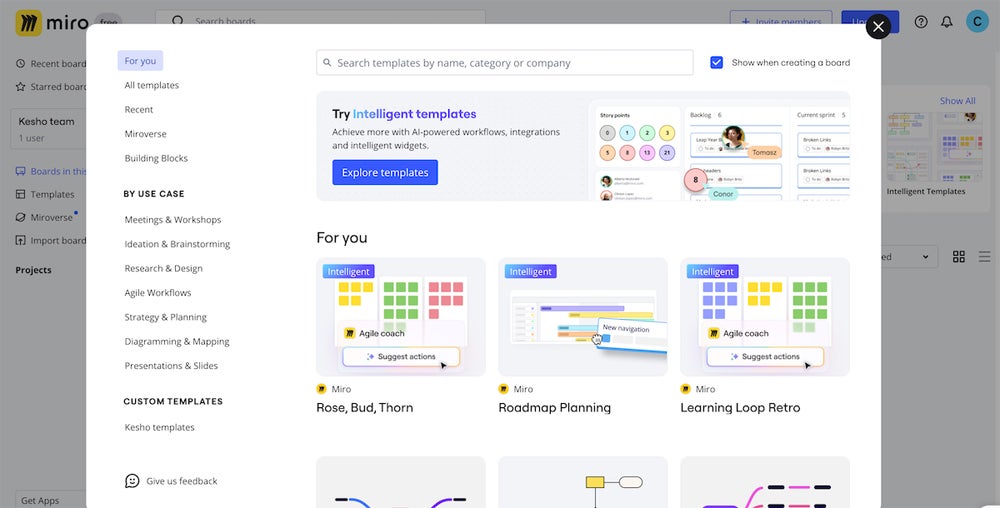

Miro: Best for collaborative whiteboarding

Miro is a leading collaboration platform that allows teams to brainstorm, plan, and map out projects in real time using digital whiteboards. It gives teams the ability to visualize complex project dependencies, including critical paths, for better understanding. Miro’s extensive templates and tools make it easy to manage everything from agile workflows to mind maps.

Why I chose Miro

Miro made it onto my list because of the combination of visualizing project dependencies and facilitating collaboration. It’s easy to create diagrams that highlight task dependencies and critical milestones, ensuring everyone is aligned on what needs to be done to keep the project on track.

Pricing

- Free: Limited features for small teams.

- Team: $8 per user per month billed annually, or $10 per user per month billed monthly.

- Business: $16 per user per month billed annually, or $20 per user per month billed monthly.

- Enterprise: Custom pricing for larger organizations.

Features

- Real-time collaborative whiteboarding.

- Pre-built templates for agile workflows, mind maps, and more.

- Integration with tools like Slack, Jira, and Google Workspace.

- Advanced security features for Enterprise plans.

Pros and cons

| Pros | Cons |

|---|---|

|

|

Key features of critical path software

Project management tools that can track critical paths offer powerful organization and reporting. The features below are some of the most popular ones you will see, but there are certainly many other important capabilities.

Think of these features as a starting point, and then add any other integral project features to your list depending on your requirements.

Data visualization

Some project management tools offer diagrams, flowcharts, and mind-mapping functionality. These will offer more customization and detail for developing the critical paths your team needs to follow. If the software is entirely for visual designing, then it may not have other features like setting task dependencies or resource allocation.

Gantt charts

These are a specific form of data visualization that schedules the people involved and their tasks in an easy-to-understand timeline. It can show task dependencies and individual deadlines as well. Gantt charts are a great option if you aren’t planning to build a custom flowchart or diagram to show the project’s critical path.

Reporting

Most project tools have some form of reporting, but ones especially suited for tracking critical paths will offer custom insights. Reporting for both the micro and macro parts of projects will revolutionize decision-making for your team.

You can focus on tasks, milestones, time spent, budgets, rates, progress of each team member, and much more. It’s one thing to know the overall result of a project, but being able to break it down and see how each step was managed is important for taking on bigger projects in the future.

Time tracking

Time management can apply to employee hours, project completion, individual tasks, budgets, and more. If your project’s critical path takes quite a long time for each dependent task to be completed, it may not be worth doing again, especially if there is a drain on the budget. Conversely, if your tasks are completed quickly and consistently, some projects may be worth repeating.

Task dependencies

One of the most important parts of planning a project’s critical path is making sure everything follows an order of operations. If a task gets completed out of order or is confused between different team members, you can end up doubling the time just to fix everything. Setting dependencies and being able to view the timeline in a Gantt chart allows everyone to see who is doing what and when.

What are the benefits of critical path software?

Critical path project management tools offer capabilities to visualize and manage a project’s specific order of operations. It will help you organize through scheduling, sending reminders, messaging, allocating roles and resources, as well as being able to visualize the timeline.

Some of the general benefits include:

- More effective communication and collaboration.

- Ensuring steps are assigned to the right people and completed in the correct order.

- Offering templates or Gantt charts to visualize a specific process or project while including deadlines and people involved.

- Time management for everyone on your team.

- Easy integrations to import data from email and databases.

- Improve the team’s ability to see the macro and micro of long-term projects.

- Offer a baseline to make changes and decisions more effectively.

How do I choose the best critical path software for my business?

When it comes to choosing any software, you need to consider the features that are essential to your project and also be willing to cut down on more expensive features that aren’t hard requirements.

Some of the functionality to track critical project paths can be pricier, especially if you want resource allocation and time management. The bright side is that most of the popular feature-rich tools have options for tracking critical paths in projects, including Gantt charts.

After you’re sure of the necessary features, you should ask yourself:

- Will this handle my project’s data?

- How does it notify team members of task completion?

- Is the user interface overly complicated?

- Will my team be able to learn the software quickly enough?

- Can anyone reading the chart templates or generated Gantt charts understand every detail?

- How does it track time — for the whole project, each task, or each person?

- Is it easy to make changes to deadlines and tasks without starting over?

- Does it offer enough features to justify the yearly cost?

- Would it be easier to just use a free tool like Figma or assign one person to track project changes?

- What other value does the software offer besides critical path generation?

Frequently asked questions (FAQs)

What is critical path software?

Critical path software is a project management tool designed to help teams identify and manage the sequence of tasks that determine the project’s overall duration. It focuses on pinpointing the critical tasks that must be completed on time to prevent delays in the project timeline.

What is the critical path in project management?

The critical path in project management is the longest sequence of dependent tasks that must be completed for a project to finish on time. It’s crucial because any delay in these tasks will directly impact the project’s overall timeline.

What is an example of a critical path?

An example of a critical path could be in a construction project where tasks like laying the foundation, erecting the framework, and installing electrical wiring must happen sequentially. Delays in any of these tasks would push back the entire project completion date.

Methodology

I evaluated the software tools on this list based on features for managing complex projects such as task dependencies, reporting tools, and Gantt charts. I also considered their pricing plans and real-world user reviews to understand how their users respond to their prices and understand their experiences with critical path tools. Finally, I tested the software tools where possible to understand whether they match up to what customers are saying and also determine what use each software is best for.