- Shipments of smart TVs in the screen size range of 55” and above increased 18% YoY.

- Smart TV contribution to overall TV shipments was over 91% in H1 2023.

- Online channels contributed 39% of the overall shipments during the year.

- Dolby Audio has become the de-facto audio technology for smart TVs.

New Delhi, Boston, Toronto, London, Hong Kong, Beijing, Taipei, Seoul – October 3, 2023

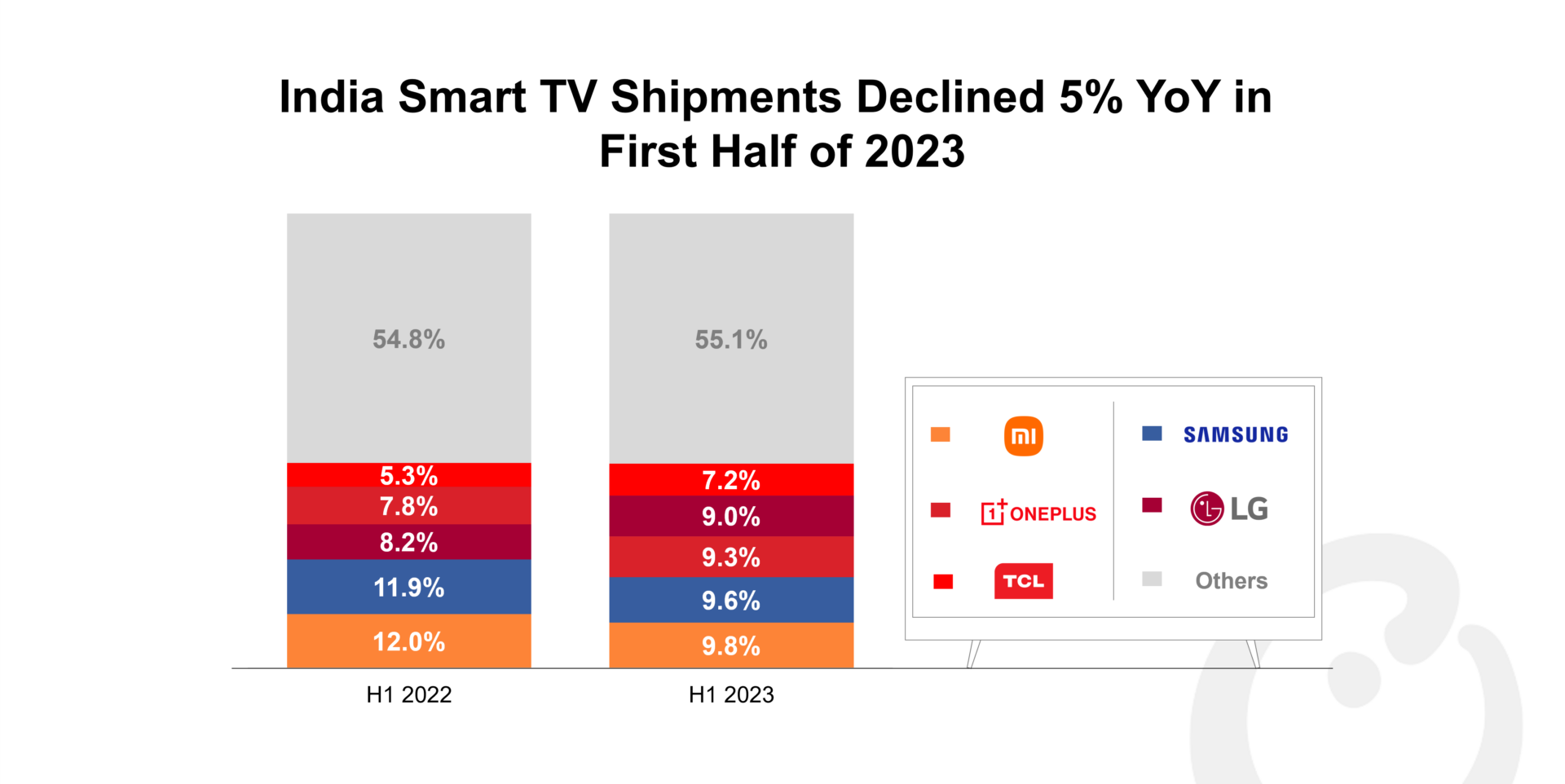

India’s smart TV shipments declined 5% YoY in H1 2023, according to the latest research from Counterpoint’s IoT Service. The decline was primarily due to the prevailing inflation and other macroeconomic headwinds in the country, which forced people to restrict their purchases to essential items.

Commenting on the market trends, Research Analyst Akash Jatwala said, “Many people bought their first smart TV during the COVID-19 pandemic, especially the 32” size. After experiencing the benefits of smart TV, they are now preferring bigger screen sizes for their living rooms, especially 43” and 55”. In H1 2023, the demand for bigger screen size smart TVs (55” and above) increased by 18% YoY. Further, consumers looking to upgrade their smart TVs will prefer a premium product due to the availability of better features.

Smart TV share in overall shipments reached its highest ever of 91% during the first half of 2023. This share is expected to go up further due to the increasing broadband penetration and the rising popularity of OTT platforms, among others.”

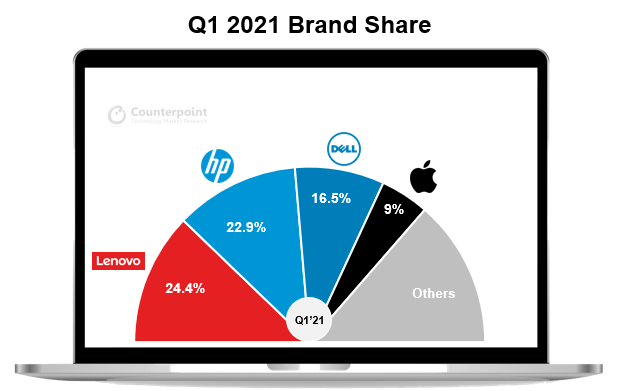

Note: Xiaomi’s share includes Redmi’s share

Looking at the market dynamics, Senior Research Analyst Anshika Jain said, “The OTT services are helping in the growth of smart TVs due to the streaming of popular sports events, TV series, and movies, which creates stickiness among the consumers. Both OTT services and smart TVs offer a better viewing experience due to enhanced display technologies and the availability of features like Dolby Atmos and Dolby Vision.

While Dolby Audio surround sound has become the de facto audio technology for smart TVs, we are now seeing many smart TV SKUs also supporting both Dolby Atmos and Dolby Vision. Smart TVs with these features are now available in the price range starting from INR 20,000. With the upcoming festive season, rising consumer awareness, and broadcast of multiple sports events, especially the Cricket World Cup, on the OTT platforms, Dolby’s penetration is expected to increase further in the smart TV segment.”

QLED TVs are becoming popular in the mid-segment (INR 30,000-INR 50,000) as most of the brands are launching affordable QLED TVs with smaller screen sizes. QLED TV shipments increased more than 21% YoY in H1 2023 and their contribution in the overall smart TV sales is expected to rise further.

Market summary for H1 2023

- Xiaomi continued to lead the smart TV market in H1 2023 with a 10% share. During this period, Xiaomi launched the X Pro series, Mi TV X series and Mi TV 5A Pro series.

- Samsung took the second spot in the smart TV market in H1 2023. During the period, Samsung launched newer models in its QLED series and Crystal 4K series. Samsung also held a TV fest where it offered great deals on the S23 Ultra and The Freestyle projector and a soundbar with selected QLED and OLED models.

- OnePlus was one of the fastest-growing brands and ranked third in H1 2023. The Y1S and Y1s Pro series were among its bestsellers. During the period, OnePlus launched QLED TV Q2 Pro.

- LG took the fourth spot in the smart TV market in H1 2023. During this period, the company launched multiple OLED models, including a 97” model. LG also had multiple promotions, where it offered a free soundbar, additional warranty and cashback on selected models.

- TCL ranked fifth in H1 2023 and was among the fastest-growing brands. During the period, TCL launched multiple new models, including in the 32” screen size, and held contests where it offered TCL products to the winners.

-

Acer (707%) and Sansui (148%) were also among the fastest-growing brands during the period. Both updated their portfolios and launched new models, which fetched good consumer response. With an increase in market share, Acer also entered the list of top-10 best-selling smart TV brands.

- Incumbents such as Xiaomi and Samsung are facing competition in the market, as other players are expanding their reach, especially offline, and launching products at different price points with better features.

- TV manufacturing is increasing in India with the increasing investments by OEMs in creating manufacturing capacity. Newer OEMs are also entering the market and partnering with leading brands to make their TVs.

- Consumer demand is shifting towards premium TVs for bigger screen sizes and better features. But still, the INR 10,000-INR 20,000 price band captured the largest share of 37% in the overall smart TV market in H1 2023. The shipments for entry-level budget TVs (<INR 10,000) more than doubled as this segment caters mainly to first-time buyers.

We estimate that India’s smart TV market will see a decline of 7% YoY in 2023. The second half of the year will see an increase in smart TV shipments compared to the first half due to the festive season. We will continue to see the entry of new models and an increasing push towards the online channel. The market is likely to return to normalcy in 2024 and is expected to grow by around 10% YoY. The increasing preference for premium TVs will drive the overall market’s average selling price (ASP) higher.

Note: Xiaomi’s share includes Redmi’s share

Background

Counterpoint Technology Market Research is a global research firm specializing in products in the TMT (technology, media and telecom) industry. It services major technology and financial firms with a mix of monthly reports, customized projects and detailed analyses of the mobile and technology markets. Its key analysts are seasoned experts in the high-tech industry.

Counterpoint Research

press(at)counterpointresearch.com